Part 3 of a 10 Part Series

Today we are going to discuss the power of the cap rate and how it can benefit you when partnering with a skilled management team.

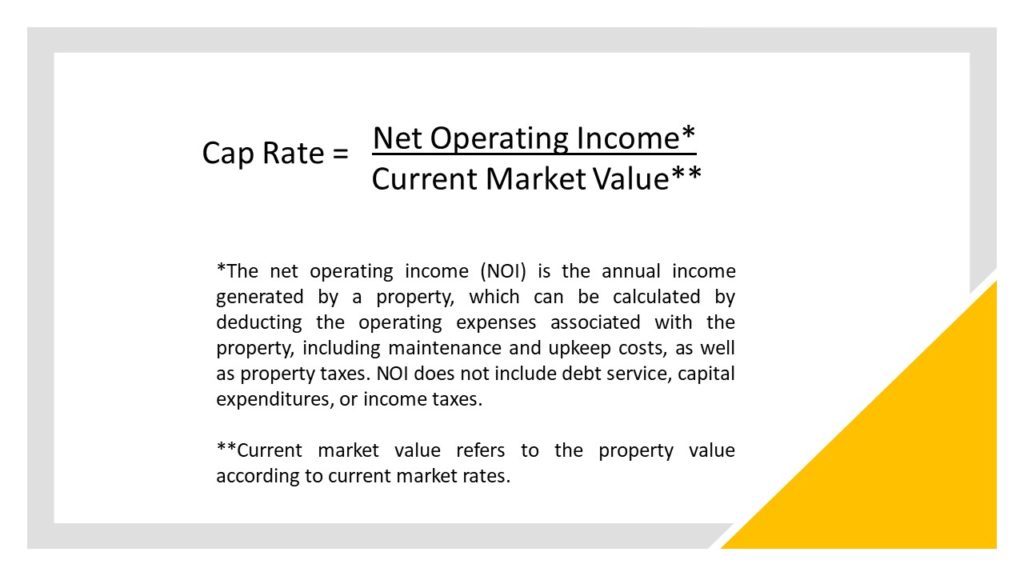

So, what is a cap rate anyway? The definition of cap rate is the annual return from operations that an investor would expect to receive for a certain asset in a specific market at the current time if the asset were to be purchased for all cash. It helps indicate the rate of return that an investor can expect to generate on an investment property. The calculation is

as follows:

The market determines the cap rate which will vary by location, property type, age of the property and level of maintenance required. The higher the risk, the higher the rate. Performing Class A properties in a large metropolitan area will have the lowest cap rates, while non-performing assets in tertiary markets will have the highest cap rates.

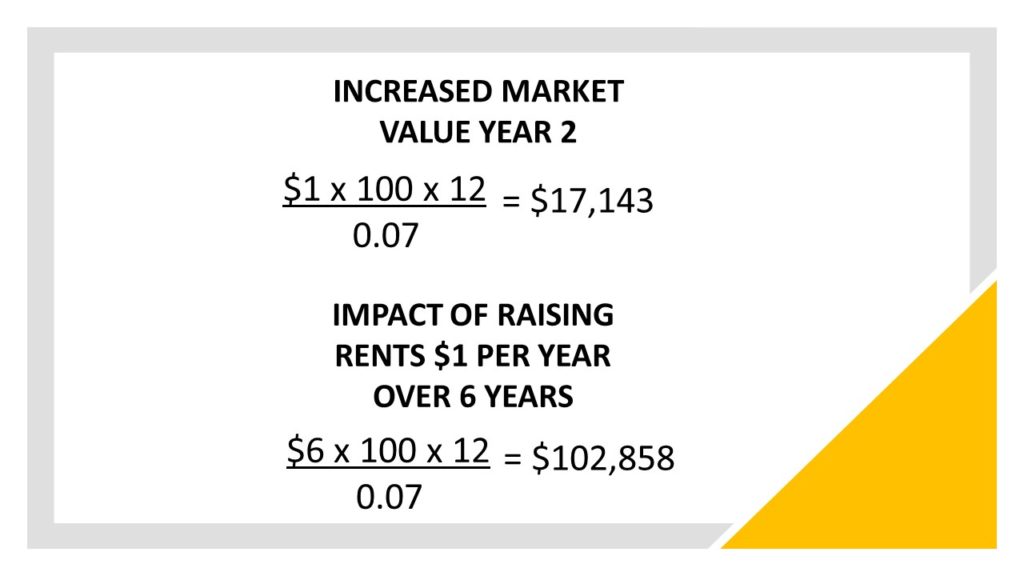

Rearranging the variables in the equation above, you can easily calculate the price of your property if you know the NOI and the cap rate. This is where it gets exciting. Watch what happens to the price of your multifamily if you increase the monthly rent of 100 units by $1 in Year 2 at a cap rate of 7%.

The value of your multifamily would increase by $17,143. Now imagine you increase your rents by another $1 each year until you sell it six years years later. As you can see in the chart above, your property value will have increased by $102,858. This certainly gives new meaning to the expression “every dollar counts” doesn’t it?

This same concept also works if the management team cuts unnecessary expenses. For example, if the management of this same multifamily reduces its annual expenses by $2,000 in Year 1, the property value will increase by $28,571 ($2,000/0.07). That’s the power of the cap rate!

I used small numbers in this illustration to make a big point. When you passively invest with the right management team, you can participate in the upside when the property is sold. What an incredible way to grow your nest egg. This is one of the many reasons I’m so glad that I discovered multifamily investing.

Click Here for Part 1 of the Series: Interest Rates Work For You

Click Here for Part 2 of the Series: More Consistent Income than Single-Family

I hope that you found this helpful in your quest to find the best place to invest your nest egg. We at East Light Investments would love to discuss the possibility of partnering with you. Please don’t hesitate to contact me directly if you have any questions.

Karen Oeser, CFA

Principal

karen@eastlightinvest.com

864-551-1820

www.eastlightinvest.com