Part 1 of a 10 Part Series

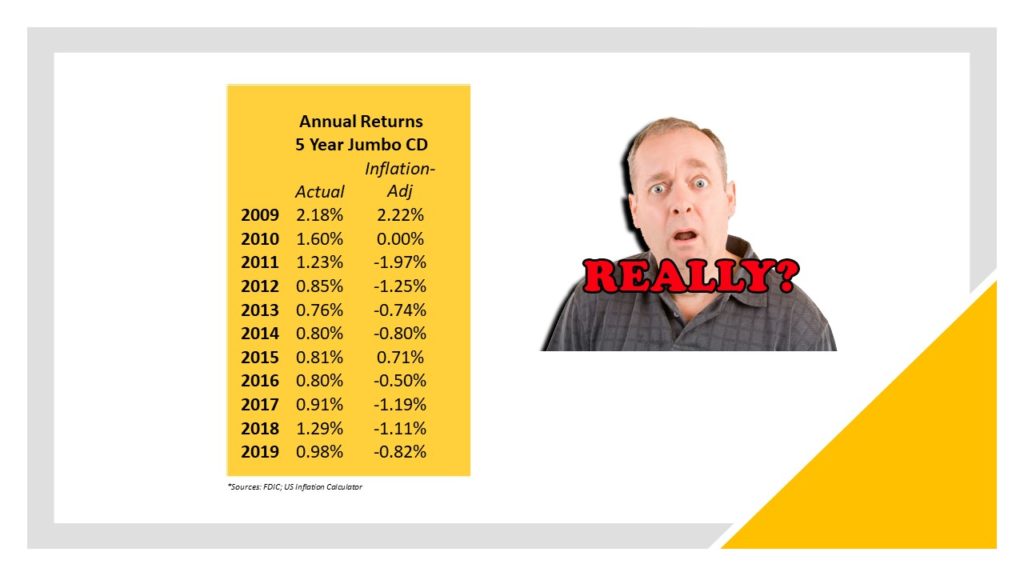

The Fed keeps lowering interest rates creating a negative ripple effect for anyone trying to earn income from their savings. We have all been disheartened walking by a bank and seeing the paltry CD returns they are offering. Not even 1%! Are you kidding me? It’s nuts! How are we supposed to retire on that?

Corporate bond rates are not much better! Ok, so they are double the return at a whopping 2%. But seriously, how are we supposed to plan our golden years when our returns are barely keeping up with inflation?

As of June 30, 2020, the government was only offering investors 0.65% per year to lock up their money for 10 years. Did you read that? Less than 1% per year? That will be a negative rate after inflation! In other words, we would be paying Uncle Sam to hold our money. Can you see your nest egg cracking now?

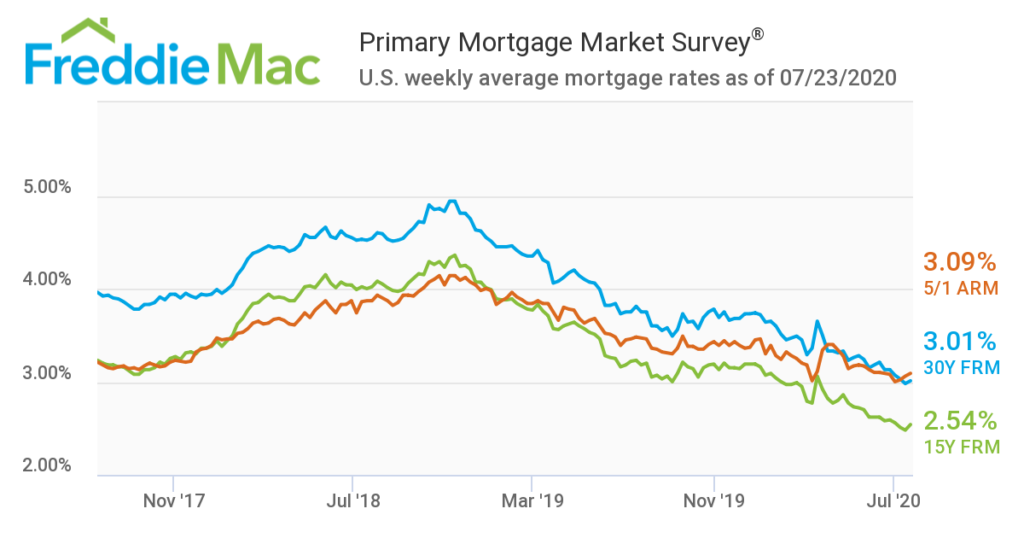

But fret not! Low interest rates can work for you. Multifamily investing provides significantly higher rates than CDs, Treasuries and corporate bonds. As a passive investor, you can earn a HIGH fixed rate because a LOW mortgage rate reduces overhead and enables the investment managers to offer you a higher return on your hard-earned savings.*

There is also another way you can potentially benefit from interest rates dropping as a preferred equity owner.** The investment management team can take advantage of the lower rates and refinance the property. This will further reduce expenses and increase the value of your invested capital.

I hope this helps you in your quest to find the best place to invest your nest egg. We at East Light Investments would love to discuss the possibility of partnering with you. Please don’t hesitate to contact me directly if you have any questions.

Karen Oeser, CFA

Principal

karen@eastlightinvest.com

864-551-1820

*Investment Manager-also known as a sponsor, is an individual or company in charge of finding, acquiring and managing a real estate property deal.

**Preferred Equity Investor-as an investor in multifamily, you are equity holder ahead of the common shareholders but subordinate to the debt holders.