Part 2 of a 10 Part Series

You have been growing your nest egg and now you’re ready to put it to work. It is no secret that real estate is one of the best ways to grow your wealth, so you decide to buy a single-family rental property. You buy it on foreclosure and lock in the mortgage at a low rate. Your monthly payment will be $750/month, your monthly operating expenses will be $100, and you can easily rent the house for $1,000/month. You sign a lease with your first tenants and net $150 per month. You’re all set. Now it’s time to kick back and cash your monthly rent checks…

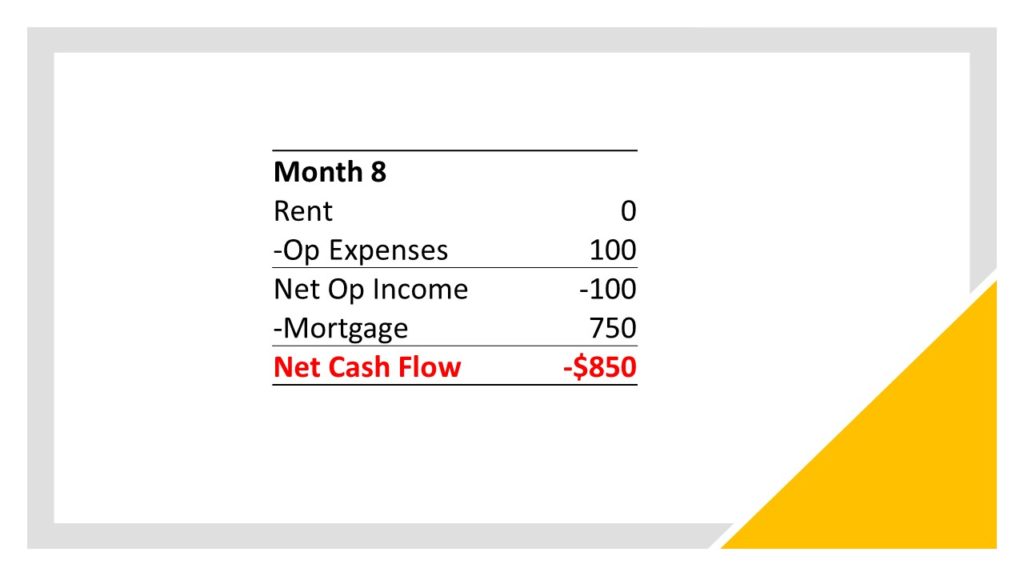

…Until month 8 when your tenant calls and can’t pay rent. But you are still on the line for the mortgage. This is what will happen to your cash flow:

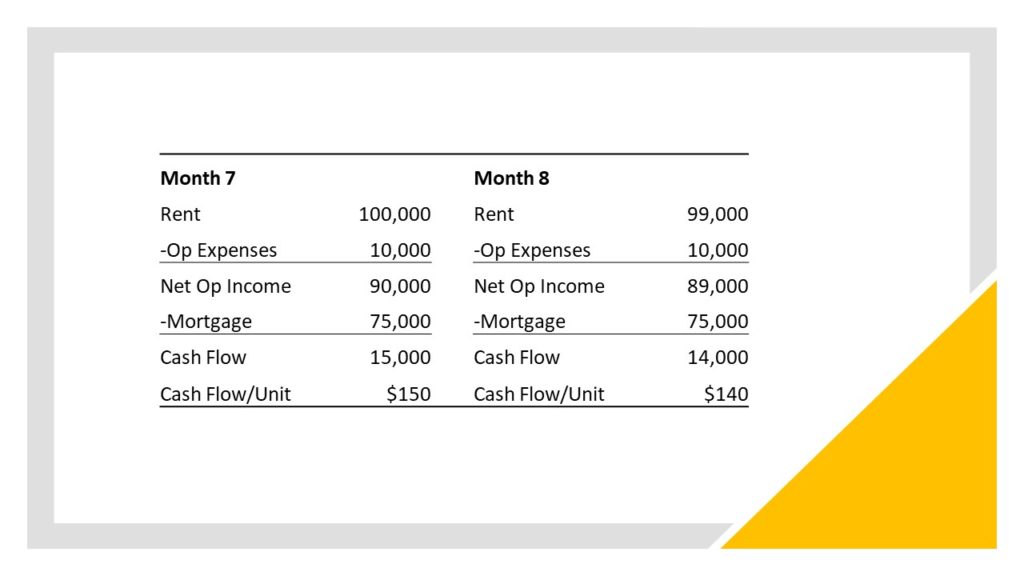

You’re devastated. That’s not exactly the scenario that played out in your mind. Now let’s consider what would have happened under these same circumstances if you owned a 100-unit multi-family property. I will assume the same rent, operating expenses and mortgage per unit to keep it simple. As you can see in the example below, your cash flow will only be reduced by $10/unit when the tenant does not pay in month 8 because you spread the loss over 99 other units.

Hang on though, the news gets even better. As a passive investor in multifamily, you don’t have to worry about knocking on doors to chase down the rent. The investment management team takes care of it for you. While your friend is dealing with City Hall to get that delinquent tenant to pay rent, you can collect your regular dividend payments and hit the links.

Click Here for Part 1 of the Series

I hope that you found this helpful in your quest to find the best place to watch your nest egg grow. We at East Light Investments would love to discuss the possibility of partnering with you. Please don’t hesitate to contact me directly if you have any questions.

Karen Oeser, CFA

Principal

karen@eastlightinvest.com

864-551-1820

www.eastlightinvest.com