Part 5 of a 10 Part Series

TAX BREAKS! Yes, that’s right. There are several ways to reduce your tax bill as a multifamily investor. I will address the five most common today.

1. Depreciation

Most people have heard of depreciation as it relates to their cars. You drive the car off the lot and it immediately loses value. The IRS treats multifamily properties the same way to account for wear and tear. However, there is a HUGE difference with multifamily because the market treats it differently. With the proper maintenance and a strong management team, the property’s value is likely to increase.

According to the IRS code, multifamily owners are allowed to depreciate their property over 27.5 years. So, to calculate the property’s depreciation amount, all you have to do is to divide the cost to acquire the property by 27.5 years. You will then deduct that same amount each year over the “useful life” of the property.

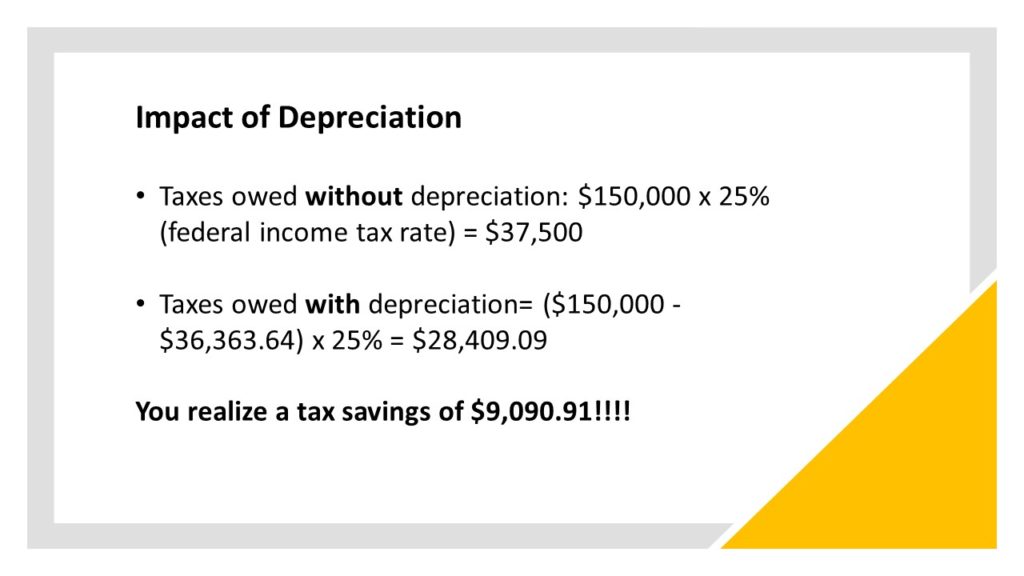

For example, if you purchase a multifamily property for $1,000,000, your depreciation expense would be $36,363.64 ($1,000,000/27.5). Now let’s assume that the property generates $150,000 per year to demonstrate the impact it would have on your taxes.

It’s seems too good to be true, but it’s not. The multifamily property owner in this example will save $9,090.9 fair and square!

2. Cost-Segregation

This benefit is similar to depreciation. The only difference is that it also involves the value of certain items such as cabinetry, fixtures, and appliances in the multifamily property. According to the IRS, these items have a shorter lifespan. That’s why they allow real estate investors to make depreciation expense write-offs on these items for a period of 7 years.

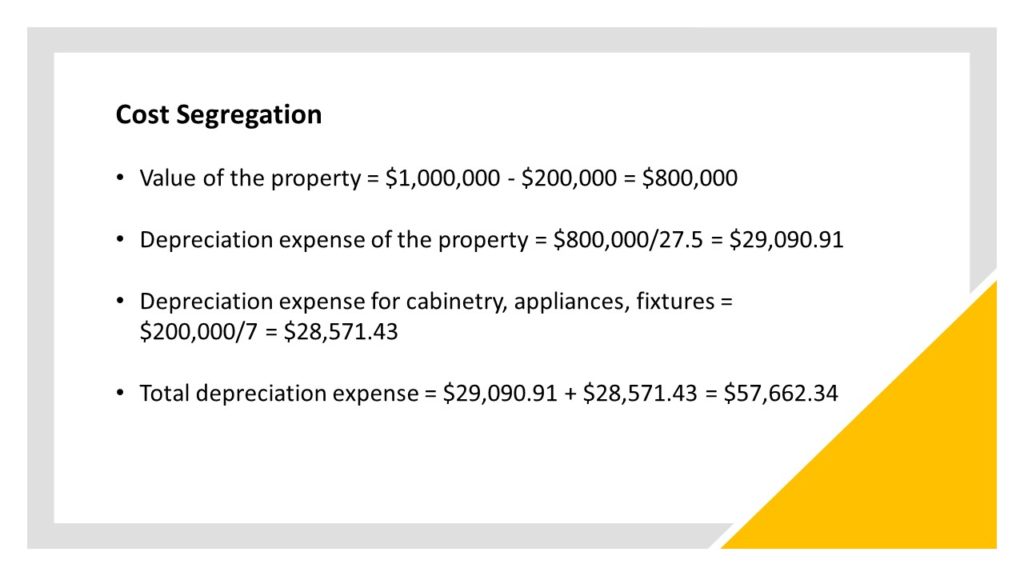

As way of illustration, let’s use the same $1,000,000 property we used in the previous example. It comes fitted with appliances, fixtures, and cabinetry worth $200,000. Your total depreciation expense would be computed as follows:

The total depreciation expense would be $57,662.34, which is higher than the $36,363.64 you could expense using straight-line depreciation. So using cost segregation is a no brainer, right? Not so fast, there’s a catch. The tax-savings is recaptured upon sale of the property. However, many investors would prefer to reinvest those savings in something else and make a higher return and pay Uncle Sam with the original amount when you sell the property. Importantly, you will have to hire a firm that specializes in Cost Segregation, but they are easy to find.

3. Tax Deductions

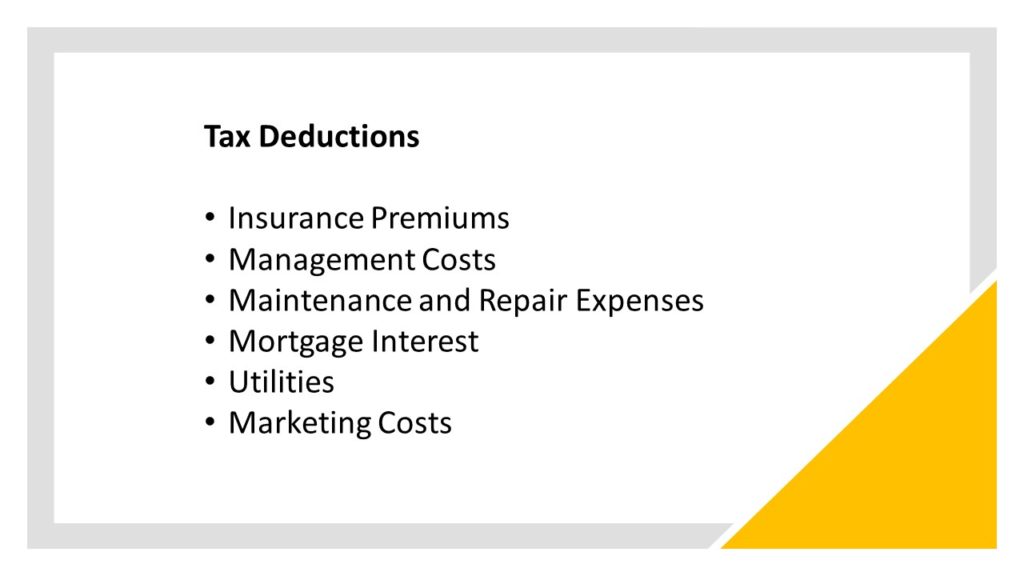

Another way to reduce your tax burden is by taking advantage of tax deductions. The law enables you to deduct the expenses you incur to manage, maintain, and repair your multifamily property from your total taxable rental income. Obviously, a smaller taxable income equals a smaller tax burden.

4. Preferential Tax Rates for Passive Investors

As I discussed in Part 2 and Part 3 of this series, passive investors earn both consistent income while holding the property and capital appreciation upon sale of the asset. The good news is that tax rates on passive income and capital gains tax are lower than federal income tax rates. Therefore, your passive investment will reduce your tax bill. And don’t forget, as a passive investor, you don’t even have to worry about those darn leaky toilets. Sounds like the best of both worlds to me!

5. 1031 Exchange

Under section 1031 of the Internal Revenue Code, a property investor can swap their rental units with little or no capital gains tax obligations if the following conditions are met: 1) The new property must be equal or greater in value than the old one; 2) The exchanged property must be used for productive business purposes; and 3) Both properties have to be “like kind.” I will be discussing this topic in more detail in a future blog. In the meantime, you can click here for more information.

I hope that you found this helpful in your quest to find the best place to invest your nest egg. We at East Light Investments would love to discuss the possibility of partnering with you. Please don’t hesitate to contact me directly if you have any questions.

Karen Oeser, CFA

Principal

karen@eastlightinvest.com

864-551-1820

www.eastlightinvest.com